How to Secure a Hard Money Financing: Actions to Simplify the Refine

Browsing the financial landscape can be challenging, particularly when it pertains to safeguarding a Hard Money Loan. These finances, normally made use of in actual estate transactions, need a clear understanding of personal funds, the financing market, and open communication with possible lending institutions. The procedure might seem facility, yet with the appropriate strategy, it can be streamlined and reliable. As we discover this topic further, you'll find vital actions to streamline this monetary trip.

Understanding What Hard Money Loans Are

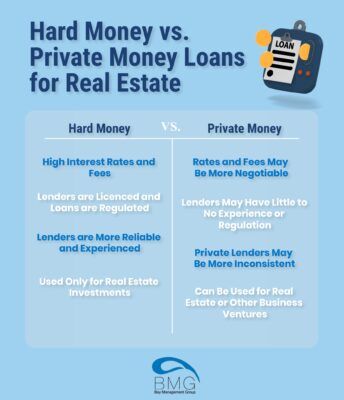

Tough Money finances, frequently seen as the financial life raft in the vast sea of actual estate, are a distinct form of financing. Unlike typical financial institution lendings, hard Money car loans are not mostly based on the debtor's creditworthiness however rather the worth of the building being acquired. Comprehending these vital attributes is essential in browsing the stormy waters of difficult Money financings.

If a Hard Money Lending Is the Right Selection for You, figuring out.

Is a Hard Money Loan the finest option for you? The solution depends on understanding your monetary situation, financial investment strategies, and credit history condition. This Lending kind appropriates for individuals with less-than-stellar credit history, as tough Money lenders largely consider the worth of the property, not the debtor's creditworthiness. Furthermore, if a rapid closing procedure is critical, a Hard Money Loan can accelerate procedures, bypassing the lengthy authorization procedure conventional fundings need. However, one must realize that hard Money loans often lug higher rate of interest. Consequently, they must analyze their ability to bear these prices. It's likewise crucial to evaluate the threat tied to the collateral, as failing to settle could cause loss of the asset. Finally, an understanding of the Finance terms is essential.

Preparing for the Funding Application Refine

Before starting the process of protecting a Hard Money Financing, it's crucial to sufficiently prepare. Prep work involves celebration required documentation such as proof of income, credit records, and an in-depth strategy of home usage. Candidates must likewise be prepared to show their capacity to make Loan payments. It's a good idea to conduct a complete residential or commercial property appraisal, as the worth of the residential or commercial property often determines the Loan quantity. A comprehensive understanding of one's economic situation is crucial. This consists of knowing all financial debts, assets, and earnings sources. Lastly, prospective consumers need to be planned for a feasible history check. Failing to properly prepare can result in delays or even being rejected of the Finance application.

Navigating Passion Prices and Loan Terms

Navigating rate of interest and Funding terms can be a complex component of securing a Hard Money Loan. Understanding rates of interest, understanding Finance terms, and bargaining positive conditions are important aspects to consider. These variables, when properly understood, can dramatically affect the general cost and affordability of the Funding.

Understanding Rates Of Interest

A considerable bulk of hard Money Financing applicants find themselves astonished by the ins and outs of rate of interest. These prices are critical to understanding the general price of a finance, as they establish the added quantity consumers have to repay beyond the principal. In the context of difficult Money loans, rates of interest are generally greater than those of standard lendings because of the inherent risk included. These car loans are generally short-term, asset-based, and offer as a last hotel for customers who can not protect funding from conventional loan providers. Lending institutions bill a costs in the form of high rate of interest prices to make up for the threat. Understanding these rates help consumers in examining if a Hard Money Loan is a sensible option or if other funding alternatives would certainly be a lot more economical.

Decoding Loan Terms

Translating the terms of a Hard Money Loan can frequently seem like a difficult task. Financing terms, typically incorporating the Finance amount, passion price, Finance duration, and settlement timetable, can significantly impact the customer's financial responsibilities. The passion rate, frequently higher in tough Money loans, is one more vital component to take into consideration.

Working Out Favorable Conditions

Securing beneficial conditions in a Hard Money Loan entails skilful negotiation and an eager understanding of rate of interest and Lending terms. One need to be fluent in More Help the dynamics of the lending market, showing a sharp recognition of present trends and future predictions. The settlement process is critical. A borrower should not shy away from reviewing terms, doubting clauses, and suggesting modifications.

Comprehending rate of interest is crucial. One need to be conscious of whether the price is fixed or variable, and just how it may rise and fall over the Funding term. It's necessary to secure a rates of interest that straightens with one's economic capacities.

In a similar way, Funding terms ought to be completely examined. Elements like repayment schedule, early repayment penalties, and default effects must be comprehended and discussed to avoid any kind of future surprises.

Reviewing and Picking a Hard Money Loan Provider

Selecting the best tough Money loan provider is a critical action in securing a finance. hard money lenders in atlanta georgia. It calls for recognizing the lender's criteria, assessing their level of openness, and considering their flexibility. These elements will certainly be taken a look at in the following sections to lead individuals in making an educated choice

Comprehending Lenders Standard

Checking Lenders Openness

While picking a Hard Money lending institution, a vital action involves assessing the lending institution's transparency. This component is essential as it ensures that all Funding problems, terms, and expenses are plainly connected and conveniently understood. Consumers are motivated to be mindful of lending institutions who stay clear of answering inquiries, give uncertain details, or show up to have actually hidden fees. It is recommended to request a clear, thorough created proposal laying out all elements of the Loan contract. This consists of rates of interest, repayment terms, and any type of prospective fines. In addition, a transparent loan provider will openly discuss their loaning procedure, approval standards, and any type of affiliated threats. In significance, the customer's capacity to comprehend the Funding contract significantly depends upon the lending institution's transparency.

Analyzing Lenders Versatility

Ever thought about the importance of a lending institution's adaptability when searching for a Hard Money Lending? Adaptability may show up in numerous types, such as versatile Funding terms, willingness to work out visit the website charges, or approval of non-traditional security. When safeguarding a Hard Money Lending, do not neglect the element of lender adaptability.

What to Expect After Safeguarding Your Difficult Money Loan

As soon as your difficult Money Loan is protected, a new phase of the lending process begins. The customer now gets in a settlement duration, which may differ depending on the specifics of the Lending contract. This duration is generally temporary, ranging from 12 months to a couple of years. It is essential for the borrower to comprehend the terms of the Finance, consisting of the rate of interest and settlement timetable, to stay clear of any kind of unpredicted problems.

Hard Money car loans commonly come with higher interest prices than conventional lendings due to their inherent danger. Thus, punctual settlement is encouraged to minimize the price. Lastly, it is necessary to preserve an open line of interaction with the lender throughout this stage, guaranteeing any type of issues are attended to promptly.

Final thought

Finally, protecting a Hard Money Lending entails comprehending the nature of such lendings, evaluating personal monetary situations, and discovering an ideal lending institution. Persistent preparation, cautious navigation of passion rates and Financing terms, in addition to open communication with the lender can simplify the procedure. Being mindful of post-loan responsibilities can guarantee successful Finance management. These steps can assist individuals in securing and successfully managing a Hard Money Finance.

Browsing interest prices and Lending terms can be an intricate component of protecting a Hard Money Funding. In the context of difficult Money car loans, interest prices are typically higher Recommended Site than those of typical financings due to the fundamental threat involved. Finance terms, usually incorporating the Loan amount, passion rate, Loan period, and repayment timetable, can significantly influence the customer's monetary responsibilities.Protecting positive conditions in a Hard Money Loan involves skilful negotiation and a keen understanding of interest prices and Lending terms.In final thought, protecting a Hard Money Financing entails comprehending the nature of such loans, analyzing personal monetary conditions, and locating an appropriate lender.